The first part of the analysis outlines the basic ideas of Islamic finance, emphasizing its moral, legal, and Shariahcompliant foundations. After that, it shifts to explaining the ins and outs of reward-based crowdfunding, breaking down its incentive systems, operational framework, and effects on investors and project developers. The suitability of reward-based crowdfunding models with Islamic finance principles—such as the proscription of riba (interest), gharar (uncertainty), and conformity to moral investment standards—is then critically examined. The study investigates whether reward-based crowdfunding methods can be made compliant with the moral and legal guidelines set forth by Islamic finance.

Keyword : Reward-based Crowdfunding, Fintech, Islamic Finance

Fintech is characterized as the financial services of the twenty-first century .Recent growth in the mobile applications and usage of website among users have hinted the inclusion of Fintech revelation among the global financial sector. Fintech is often referred to as the blend of digital innovation and financial services with an aim to improve the efficiency of the financial service industry. therefore, regarded Fintech as the marriage of technological innovation and finance which has the ability to elevate the financial service industry to a new height. In addition to the disruption of traditional financial markets Fintech can ensure operating efficiency, improve customer-centric services and lead to better transparency in the financial service sector. is more optimistic about the role of Fintech in the financial service industry and believe that this revolution can positively improve the growth of the financial service industry by reducing the probability of a financial crisis.(Hasan et al., 2020)

The development of fintech is also quite impressive and spreads quickly to society due to its cheapness and ease of use. This is indicated by the many platforms that use fintech to facilitate business startups, both in lending and financial transactions. Of course, this is very disruptive to the old concept of using traditional methods, making it quite troublesome and a long process in borrowing funds and financial transactions. There are quite a lot of platforms that have emerged using this fintech system that utilize existing technology to simplify and speed up processes for group or individual businesses. The platforms in question include Peer-to-peer Lending, Securities Crowdfunding, Equity Crowdfunding and Reward Crowdfunding which prioritize lending for startups, SMEs and micro-businesses which are usually through bank loans but now there are many platforms that provide services in this regard.

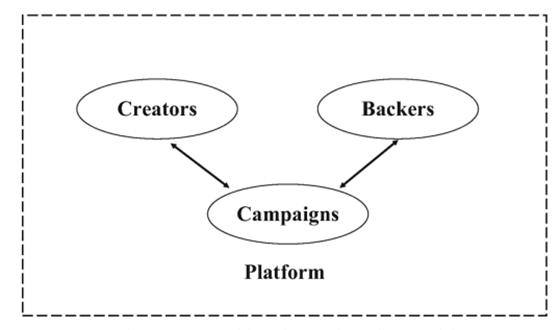

Crowdfunding is a funding model with several actors playing a role in it, namely the project owner, the Crowdfunding institution itself (online site/social media), and donors. Crowdfunding inspired by crowdsourcing describes the collective cooperation, attention and trust by people who network and pool their money together, usually via the Internet, in order to support efforts initiated by other people or organizations. Crowdfunding occurs for any variety of purposes, from disaster relief to citizen journalism to artists seeking support from fans, to political campaigns. The term Crowdfunding is derived from the better known term crowdsourcing, which describes the process of outsourcing tasks to a large, often anonymous number of individuals, a crowd of people and drawing on their assets, resources, knowledge or expertise. In the case of Crowdfunding, the objective is to obtain money.(Irfan, 2015)

Crowdfunding has many types, namely Donation based Crowdfunding, Securities Crowdfunding, Equity Crowdfunding and Reward based Crowdfunding. These 4 types of crowdfunding use the same system, namely crowdfunding from investors collecting funds to finance startup business people, SMEs and individuals. Crowdfunding has many types, namely Donation based Crowdfunding, Securities Crowdfunding, Equity Crowdfunding and Reward based Crowdfunding. These 4 types of crowdfunding use the same system, namely crowdfunding from investors collecting funds to finance startups, SMEs and individual businesses. In this context, there is something quite interesting related to one type of crowdfunding, namely reward crowdfunding, which is quite recently known for financing business people to create products or develop products with the benefits obtained being other products or services.

Rewards-based crowdfunding can be considered as the most common familiar crowdfunding model, where backers contribute to a project by forfeiting any monetary profits. Instead, they expect to receive material (e.g. real products) or immaterial compensation (e.g. thank you letters) in return for contributions. The rewards commonly used in reward-based crowdfunding campaigns fall into three categories of pre-order, service, and recognition. Specifically, the campaign creator offers his product in a pre-order mechanism through which supporters have early access to the product. As part of the process, contributors also evaluate the product and may offer its creators useful suggestions about how to make the product better meet their needs. Recognition and service are examples of immaterial rewards (Zhao & Ryu, 2020).

In this case, it is quite interesting how the scheme prepared by this type of crowdfunding is different from others in that its segmentation is more about hobbies or individual businesses to be financed for both product development and services. then how does Islam view this transaction, whether it is halal or haram in terms of the transaction. This analysis will help in the creation of an Islamic framework for crowdfunding by looking at the moral and legal issues that arise in reward-based crowdfunding. This will clarify the possible obstacles and advantages for investors and business owners who wish to use reward-based crowdfunding in accordance with Islamic law. In addition, this will help Islamic finance industry players understand and navigate the intricacies of this cutting-edge financing model. In short, the aim of this analysis is to establish a link between the concept of Islamic finance and the rapidly changing world of crowdfunding. It aims to support the expansion and development of reward-based crowdfunding in the context of Islamic finance by highlighting key areas of convergence and divergence and offering viable solutions.

METHODOLOGY

The methodology in this research is a method of gathering information from various points of view in order to promote the quality of the research and achieve objective and comprehensive conclusions. The data collection approaches used in the research include library research, field research, and documentation studies. The sources of information used in this study approach are regulations governing the merging of Islamic State-owned banks, books, literature, previous research, and other related books. Only those that are specifically linked to the topic are chosen for this data source. The authors used the qualitative research method in this study, which is a research approach that examines and generates descriptive data results in the form of written words. This research approach uses the written word method rather than the statistical method to generate data.

DISCUSSION

Reward Crowdfunding Scheme

If viewed from a philosophical perspective, the concept of reward-based crowdfunding is aimed at achieving an inclusive economy, namely providing funding for all levels of Indonesian society fairly in order to improve welfare and reduce disparities between groups. With the existence of crowdfunding sites, people can participate in donating funds anytime and anywhere and funding mobilization becomes wider, especially for the social entrepreneurship sector. Therefore, in order to make the benefits of crowdfunding even more massive, the author brings the concept of reward based crowdfunding closer to social entrepreneurs who primarily have funding and capital problems so that they can access better and fairer funding by using a reward based crowdfunding scheme. This scheme is a solution that can accommodate the special characteristics of social entrepreneurs in order to obtain funding which will later be used to fund social projects from various sectors. Often, the campaign is shared on social media with the hope that the business owner's followers will, in turn, share the campaign with their networks. Platforms typically charge a percentage that can be as low as 5% to as high as 13% of funds raised, and may charge an additional processing fee (Shneor et al., 2021).

Business owners describe their project or business idea and fundraising goal on a crowdfunding platform. In return for donations, businesses provide rewards. For example, a jewelry designer might reward everyone who contributes $100 with an original handmade bracelet or an inventor of solar-powered lawn mowers might give a mower to contributors at the $1,000 level. This type of financing is geared toward startups, particularly in creative fields, that don't Qualifies for traditional small-business loans but has compelling projects or wants to test a market. Small businesses with a complex product or service might want to explore traditional funding options; it might be hard to explain the value of your company in layman's terms to a crowdfunding audience. Reward-based crowdfunding can be considered as the most publicly familiar crowdfunding model, where backers contribute to projects without any monetary returns. Instead, they expect to receive material compensations (e.g. real products) as well as immaterial compensations (e.g. thank-you letters) in return of their contributions The rewards commonly used in reward-based crowdfunding campaigns fall into three categories : pre-orders, services , and recognition (Pinkow, 2023).

Sharia Aspect Reward Based Crowdfunding

Islam emphasizes the principle of Halal (permitted activity) emanating from the Shariah, which governs all activities in the life of Muslims. The Islamic Finance, ideally, is an alternative way of financing based on ethical and socially responsible standards, which ensures fair distribution of benefits and obligations between all the parties in any financial transaction. The crowdfunding carries these characteristics and provides the ground for new developments in the field, as it can use Islamic finance as an ethical and socially responsible tool to promote financing and development. Islamic finance and crowdfunding both conceptualize customers as investors and can potentially provide investment opportunities with higher returns. Investors take an equity stake in the project and gain returns based on the principle, which ensures a fair distribution between shareholders and entrepreneurs.

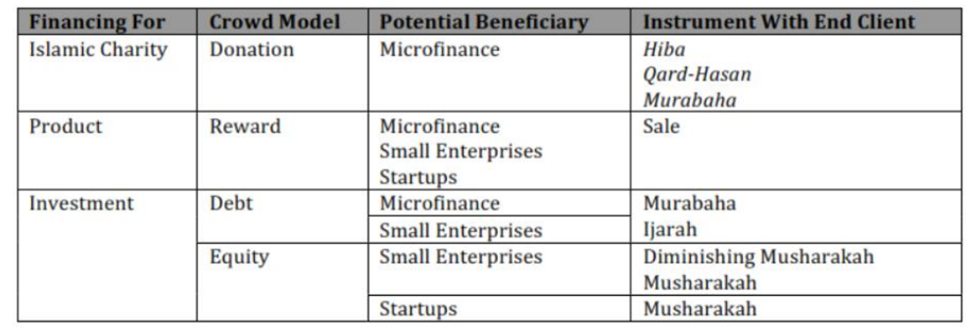

In the case of reward-based crowdfunding, potential beneficiaries include microfinance, small enterprises and startups. While microfinance and startups are generally financed through pure equity, small enterprises, notably family businesses, prefer to purchase back their own shares rather than being acquired by outside parties, therefore all of them use sale akad. According to the study, the results show that both fintech and crowdfunding are still in their early stages in the Islamic world, with a relatively small number of participants, remain closely oriented to start-ups, and there are not enough investors while adopting sharia compliant methods and procedures for finding investors and selecting business ideas(Marzban & Asutay, 2014).

CONCLUSION

In summary, reward-based crowdfunding is used to fund microfinance, small and medium businesses, and startups. Crowdfunding based on rewards can also be used to fund a wide range of initiatives, works, creative ideas, and projects. Based on the notion of social solidarity to reward or service ideas or projects, as well as the better allocation and utilization of financial resources. It is consistent with Islamic finance, which, if practiced properly, is seen as a revolution in financing techniques in the Islamic world. Crowdfunding in the Islamic world continues to progress slowly, encountering several challenges. These challenges include technological limitations, slow processing of digital financial transactions, issues related to liquidity, and the relatively high living standards prevalent in the Gulf Cooperation Council (GCC) nations. However, it's clear that within the Islamic world, a community of innovative and entrepreneurial minds exists. For these individuals, crowdfunding provides a promising avenue to navigate away from the complexities of traditional financing methods. It offers a swifter, more accessible, and less risky alternative. The fusion of Islamic finance principles, crowdfunding, technological advancements, and the burgeoning Fintech sector presents a substantial opportunity. It can significantly enhance the entrepreneurial landscape within the Islamic world and contribute to fostering social and economic progress.

REFERENCE

Hasan, R., Hassan, M. K., & Aliyu, S. (2020). Fintech and Islamic Finance: Literature Review and Research Agenda. International Journal of Islamic Economics and Finance (IJIEF), 3(1). https://doi.org/10.18196/ijief.2122

Irfan, M. (2015). CROWDFUNDING SEBAGAI PEMAKNAAN ENERGI GOTONG ROYONG TERBARUKAN. SHARE: SOCIAL WORK JURNAL, 6(1), 1–153. http://www.instink.co.id

Marzban, S., & Asutay, M. (2014). Shariah-compliant Crowd Funding: An Efficient Framework for Entrepreneurship Development in Islamic Countries. ResearchGate.

Pinkow, F. (2023). Determinants of overfunding in reward-based crowdfunding. Electronic Commerce Research. https://doi.org/10.1007/s10660-023-09681-w

Shneor, R., Munim, Z. H., Zhu, H., & Alon, I. (2021). Individualism, collectivism and reward crowdfunding contribution intention and behavior. Electronic Commerce Research and Applications, 47. https://doi.org/10.1016/j.elerap.2021.101045

Zhao, L., & Ryu, S. (2020). Reward-Based Crowdfunding Research and Practice. ResearchGate, 119–122. 10.1007/978-3-030-46309-0_6